London Wall mines and claims

London Wall group of mines and claims (Matabeleland Province, Zimbabwe)

The London Wall group of mines highlighted within the Long Strike option claim area, outlined in blue. The three London Wall shafts are shown to the west and the New Jessie Mine to the east. The producing Jessie Mine on strike from the London Wall group of mines is shown to the southeast, outside the claim area.

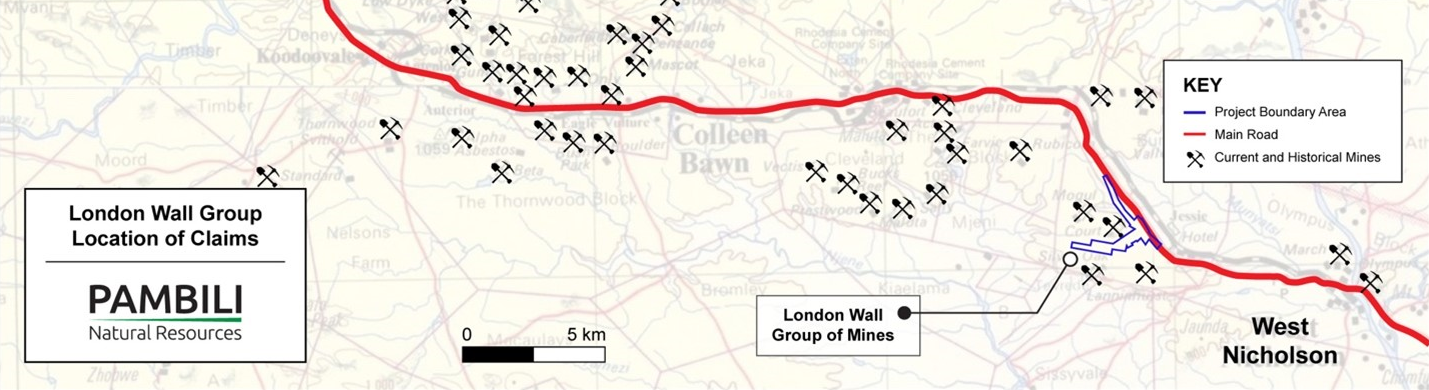

Regional map highlighting the location of the London Wall group of claims and surrounding mines.

On Nov. 20, 2024, Pambili signed a 12-month option agreement with Long Strike Investments (Private) Limited to acquire the London Wall group of gold mines and claims located in the Gwanda district of Matabeleland, Zimbabwe.

Under the terms of the option, Pambili has the right to acquire 21 gold claims, which cover 173 hectares and include the previously producing London Wall and New Jessie mines. In addition, Long Strike has applied for contiguous extensions to the claims, totalling an additional 547.8 ha. Once granted, these extensions are included in the option.

The claims are located on three interpreted major regional gold-bearing geological structures. A regional dolerite sill has acted as a natural barrier, potentially protecting significant, previously unrecognized gold mineralization underneath that sill.

A “right-to-mine” agreement, signed as part of the option, allows Pambili to commence gold production at London Wall, initially by processing tailings and sands, and then moving into underground mining.

Grab samples taken from an artisanal miner’s production at the West Shaft of the London Wall mine.

The London Wall and New Jessie mines were both mined as recently as two years ago; Pambili expects to bring at least one of these mines back into production within the term.

Grab samples of recently mined ore from the London Wall West Shaft, taken by Long Strike, returned values of 4.4 grams per tonne (g/t), 15.7 g/t and 24.4 g/t (samples analyzed at a local non-accredited laboratory).

Pambili will retain 95% of any gross income generated from the claims and mines during the term. Pambili has a 12-month option to acquire the mines, with the ability to extend the option for a further 12 months as required.

Jon Harris, Chief Executive Officer of Pambili Natural Resources, commented:

“This opportunity is a major step forward for Pambili. We are excited to establish a second mining hub with the potential to deliver on Pambili’s target of becoming a significant gold producer in Zimbabwe. The Option to acquire the London Wall group of mines provides Pambili with a potentially significant source of near-term cash flow, and also provides time to further evaluate the Claims and Mines ahead of a possible exercise of the Option.

Although the historical data has yet to be independently verified, the reported figures corroborate previous production records, and we are excited to have this opportunity to confirm the potential of the the project.

The immediate goal will be to rehabilitate the static leach tanks at London Wall and commence re-processing the gold tailings to generate revenue. A simultaneous evaluation of the underground operations should define the scope and related cost of bringing the East Shaft back into production. Given that the shaft was last operated less than two years ago, we believe it should still be in good condition.

A site near the East Shaft will be prepared for the installation of a 20-tonne-per-day crushing and milling plant that has already been purchased by Long Strike.”

Golden Valley Mine: NI 43-101 Report

Pambili Corporate Presentation

Click here or on the image above to view or download our Q2 2024 corporate presentation on the bright promise of small-scale gold consolidation in Zimbabwe.

Click here or on the image above to see the updated NI 43-101 technical report for the Golden Valley Mine, approved by the TSXV exchange, near Bulawayo, Zimbabwe.